SIM swap fraud is one of the fastest‑growing digital crimes in Pakistan. Criminals trick mobile operators into issuing a duplicate SIM, then intercept your OTPs to empty bank accounts, mobile wallets (Easypaisa, JazzCash), and email or social media. This guide explains how SIM swap works in Pakistan, real user experiences, what to do in the first 15 minutes, and the practical steps to lock down your number and money.

For awareness and lawful verification, explore SIM Owner Details Pakistan: https://www.simownerdetailss.com.pk/

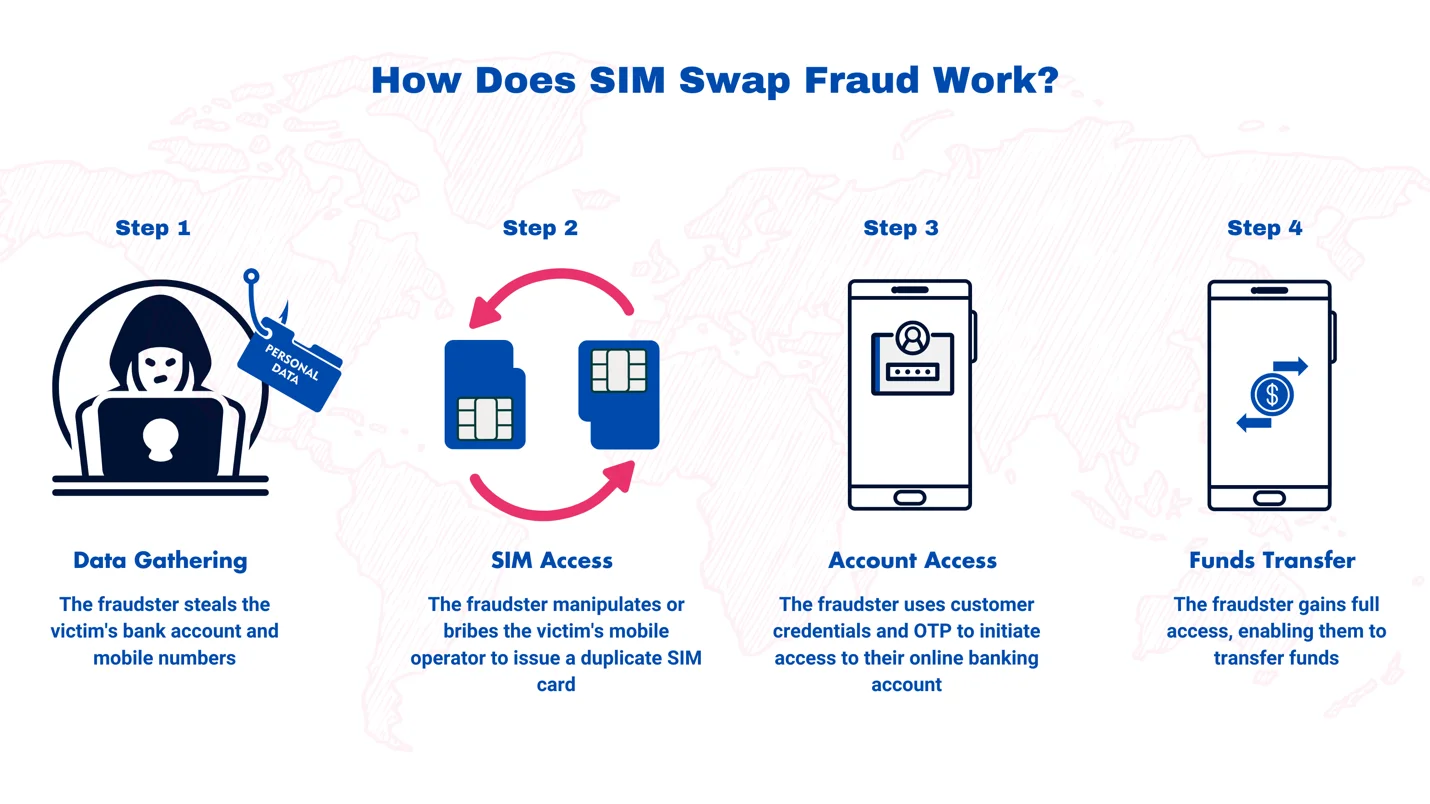

WHAT IS SIM SWAP FRAUD?

A SIM swap (also called SIM hijacking or SIM port-out) occurs when a fraudster transfers your mobile number to a new SIM they control. Once they control your number, they can:

- Reset your email and social accounts

- Intercept bank OTPs and confirm transactions

- Drain mobile wallets and approve loan/BNPL requests

- Bypass 2FA that relies on SMS

In Pakistan, SIM issuance requires Biometric Verification System (BVS) and CNIC, which reduces, but does not eliminate, risk. Attacks still happen through social engineering, document theft, data leaks, or insider collusion.

WHY PAKISTAN IS A TARGET

- High reliance on SMS OTPs for banking and wallets

- CNIC copies are often shared with vendors/agencies; leaks circulate

- Biometric verification can be bypassed through collusion or counterfeit prints

- Rapid digital adoption (apps, wallets, e‑commerce) with uneven security hygiene

USERS’ EXPERIENCES (ANONYMIZED)

- Karachi salaried professional: Lost signal at night; by morning, multiple debit alerts appeared. The attacker swapped his SIM, accessed email via SMS reset, then his bank app. Recovery took 3 days; funds reversed after bank investigation.

- Lahore SME owner: Received a “SIM replacement pending” call from a fake “operator” rep. He shared a one‑time PIN sent by the network, instantly lost service. Immediate in‑person visit to his carrier and bank minimized losses.

- Rawalpindi student: Social account takeover first; email and number compromised later. The attacker used the same number to reset everything. Switching to app‑based 2FA prevented a second attempt.

SIGNS YOU’RE UNDER A SIM SWAP ATTACK

- Sudden loss of signal (“No Service/Emergency Calls Only”) while others around you have coverage

- You stop receiving calls or SMS, especially bank OTPs

- Alerts for SIM replacement or “new device sign‑in” you didn’t perform

- Bank/wallet/email password reset notices without your action

HOW TO STOP A SIM SWAP IN THE FIRST 15 MINUTES (PAKISTAN)

Follow this order. Speed matters.

- Call your mobile operator from another phone and request an immediate line block/hold

- Jazz: 111

- Zong: 310

- Ufone: 333

- Telenor: 345

If you can’t reach them quickly, go to the nearest official franchise/service center with your original CNIC for biometric re‑verification and SIM restoration.

- Freeze your money

- Call your bank’s helpline (on your debit/credit card or official site) and request emergency block on transfers, mobile/internet banking, and card transactions.

- Temporarily disable wallets (Easypaisa, JazzCash) via helpline/app; change passwords from a safe device.

- Secure your accounts

- From a trusted device and network: change email, social, and banking passwords; revoke active sessions; turn on app‑based 2FA (Google Authenticator, Microsoft Authenticator) instead of SMS codes.

- Report the crime

- PTA complaint portal: https://complaint.pta.gov.pk/

- FIA Cyber Crime Wing: 1991 (toll‑free) and https://complaint.fia.gov.pk

- Keep a record: time of outage, suspicious SMS/calls, bank alerts, complaint numbers.

- Audit your SIM records

- Check how many SIMs are registered to your CNIC: SMS your CNIC (without dashes) to 668 or visit https://cnic.sims.pk/

- Immediately block any unknown numbers registered to your CNIC.

SIM SWAP PROTECTION CHECKLIST (DO THESE TODAY)

Secure your phone and SIM

- Enable SIM PIN: Settings > Security > SIM Card Lock (Android) or Settings > Mobile Data > SIM PIN (iPhone). Store your PUK securely.

- Lock your device with a strong passcode; enable biometric unlock and auto‑lock under 30 seconds.

- Do not share any one‑time PINs sent by your operator for SIM actions.

Lock down banking and wallets

- Prefer app‑based 2FA (TOTP) or in‑app approvals over SMS.

- Turn on transaction alerts for every debit, login, and profile change.

- Set daily transfer limits; require additional approval for new payees.

- Keep a secondary email for bank recovery that does not use your phone number for resets.

CNIC and digital hygiene

- Never post your CNIC or number publicly; watermark CNIC photocopies (Purpose + Date).

- Shred or securely delete scans of CNIC/passport and utility bills.

- Beware of “verification” calls; no genuine operator or bank ever asks for your OTP/PIN.

For businesses and high‑risk users

- Dedicated “finance” number kept private; no public listing.

- Use separate numbers for WhatsApp, banking, and MFA where possible.

- Implement mobile threat defense and MDM on staff devices.

- Maintain an incident runbook and vendor contact list for after‑hours response.

FEATURES TO LOOK FOR IN A SIM SWAP PROTECTION SOLUTION

- Real‑time SIM change detection (alerts on SIM swap events)

- Number portability and line‑status checks before high‑risk transactions

- Device binding and risk scoring (new device + new SIM = step‑up verification)

- App‑based or hardware security keys for 2FA, not SMS

- Velocity and geolocation anomaly detection for bank/wallet logins

OFFICIAL RESOURCES AND CONTACTS

- PTA SIM Information System: https://cnic.sims.pk/ and SMS CNIC (no dashes) to 668

- PTA Complaint Management: https://complaint.pta.gov.pk/

- FIA Cyber Crime Wing: 1991 and https://complaint.fia.gov.pk

- Your operator’s official site and nearest franchise/service center for biometric re‑verification

USE OUR SITE RESPONSIBLY

For lawful checks and awareness tools in Pakistan, visit SIM Owner Details Pakistan:

- SIM Owner Details Pakistan (brand homepage): https://www.simownerdetailss.com.pk/

Only perform checks you’re legally authorized to make. Respect privacy and PTA regulations.

FAQs: SIM SWAP FRAUD PAKISTAN

Q1: What is SIM swap fraud?

A: It’s when criminals transfer your number to a new SIM to intercept OTPs, reset accounts, and steal money.

Q2: Is SIM swap possible despite biometric verification?

A: Yes. Biometric rules reduce risk but can be bypassed through collusion, stolen data, or social engineering.

Q3: How do I check how many SIMs are on my CNIC?

A: SMS your CNIC (without dashes) to 668 or visit https://cnic.sims.pk/ and block any unknown numbers.

Q4: Do eSIMs stop SIM swap?

A: eSIMs reduce physical swap risk but don’t eliminate account takeover if SMS‑based OTPs remain. Use app‑based 2FA.

Q5: What if I suddenly lose network for more than 15 minutes?

A: Borrow a phone, call your operator to block the line, freeze bank/wallet access, and file reports with PTA and FIA.

Q6: Can banks reverse fraudulent transfers?

A: Many banks can recover funds if reported rapidly, but results vary by case. Report immediately and obtain a case number.

Q7: How do I make my number hard to swap?

A: Enable SIM PIN, keep CNIC private, use app‑based 2FA, set bank limits, and insist on in‑person biometric re‑verification.

Conclusion

SIM swap fraud in Pakistan is preventable. Replace SMS OTPs with app‑based authentication, protect your CNIC, enable SIM PIN, and keep a rapid response plan. If something feels off—no signal, strange OTPs—act within minutes.

For educational tools and resources, visit: https://www.simownerdetailss.com.pk/

SIM OWNER DETAILS

SIM OWNER DETAILS